Investment 207: Ryan vs Marcel

“Half a denier for my bloody life story?!”

“You can’t expect to wield supreme executive power just because some watery tart threw a sword at you.”

“Gentlemen, you can’t fight in here—this is the war room!”

A while back, we analyzed the different investment strategies implied by the Pick of the Week segment on the Brainstorm Brewery podcast. Let’s recap our conclusions from season one:

Marcel and Ryan are classic Alex-profile investors. Their picks traditionally favor low-risk, long-term growth. While they are buy-and-hold investors, they are not buy-and-forget.

Since we previously pitted the two more aggressive crew members against each other, that means we can now see what happens when the two more conservative crew members are put side by side.

Ryan’s base stats:

30-day call rate: 37 percent;

Season-ending call rate : 50 percent

30-day average return: 14 percent

Season-ending average return: 1.1 percent

Marcel’s base stats:

30-day call rate: 70.4 percent

Season-ending call rate: 17.65 percent

30-day average return: 41 percent

Season-ending average return: .89 percent

These results seem at odds with their previous results. Both of our slow-and-steady investors turned in modest long-term gains, but at the other end of the spectrum, they both crushed their 30-day results:

Marcel:

[card]Blood Baron of Vizkopa[/card]: +37 percent

[card]Ash Zealot[/card]: +76 percent

[card]Chandra’s Phoenix[/card]: +100 percent

Ryan:

[card]Chandra, Pyromaster[/card]: +255 percent

[card]Beck // Call[/card]: +100 percent

At the other end, Ryan’s average pick ended up yielding over 50 percent and Marcel’s calls fell to just above positive. This might be indicative of rotation leading folks to make blind shots at cards that are strong but unplayed. Yet even as we see uneven results, there are trends emerging. In Ryan’s 30-day time frames, roughly six out of ten of his picks failed to move upward, but he still averaged 14-percent profit per trade. Marcel’s picks started out strong and collapsed under the weight of rotation, with eight out of ten of his picks failing to gain any profit during the season. But again, the concept of Beta (see Investing 205) is coming into play here. In each case, the losses per trade were kept tightly under control and the gains per trade were outsized, resulting in returns that were much better then expected considering the number of missed calls.

Missed Calls

Here’s a few examples of Marcel and Ryan missing:

Marcel

[card]Firemane Avenger[/card]: +/-0 percent

[card]Assemble the Legion[/card]: -16 percent

[card]Whispering Madness[/card]: +/-0 percent

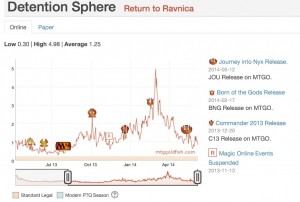

[card]Detention Sphere[/card]: -15 percent

Ryan

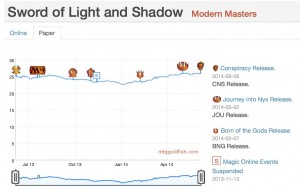

[card]Sword of Light and Shadow[/card]: -9 percent

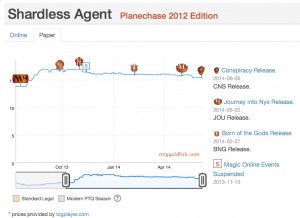

[card]Shardless Agent[/card]: +/-0 percent

The Good ‘Uns

Compare those misses to the upside on these calls:

Ryan

[card]Mutavault[/card]: +93 percent

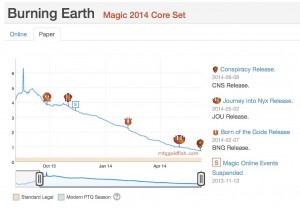

[card]Burning Earth[/card]: -79 percent (this was a sell call)

Marcel

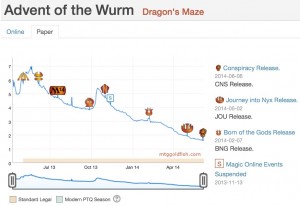

[card]Chandra’s Phoenix[/card] : +300 percent

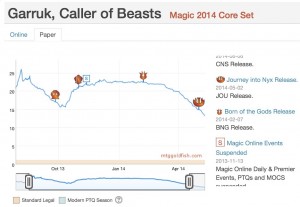

[card]Garruk, Caller of Beasts[/card]: -64 percent (this was a sell call for the paper version)

As we discussed previously, it is a little difficult to pick one over the other, as Marcel sticks almost entirely to MTGO. In this matchup, though, we see that Marcel seems to have drifted over into Jason’s side of MTG finance. While Ryan has continued his previous pattern of low-risk and value-driven picks, Ryan’s calls were less incremental then before. A gambler (Gordon profile) will more than likely find Ryan’s pick unsatisfying. As for Marcel, his picks were much more aggressive and short-term compared to his previous season. While an Alex profile might have become uncomfortable with the level of volatility this time around, the returns were still with in the range of both Ryan’s and Marcel’s spectrum of comfort.